Deloitte Talking to, PwC / Strategy&lifier and EY Advisory would be the biggest talking to firms from the globe, discloses new information by Gartner. The Large Four accounting and talking to titans together hold 40% from the market, using the top 200 firms globally disbursing nearly 80% from the $125 billion advisory market.

Deloitte Talking to, PwC / Strategy&lifier and EY Advisory would be the biggest talking to firms from the globe, discloses new information by Gartner. The Large Four accounting and talking to titans together hold 40% from the market, using the top 200 firms globally disbursing nearly 80% from the $125 billion advisory market.

Each year Gartner, a worldwide analyst firm, conducts research within the condition from the talking to industry. Its latest edition from the so-known as ‘Market Share Analysis: Talking to Services’ checks the introduction of the talking to market, along with the market shares of the most basic gamers within the landscape*.

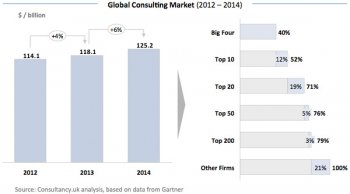

The experts discover that globally investing on management consultants is continuing to grow to $125.2 billion in 2014, up 6.1% from $118.1 billion in 2013**. The very best four biggest, with a heritage within the accountancy sector, referred to as Large Four (, PwC, and KPMG), hold a combined 40% from the total talking to market. In comparison to about ten years ago the Large Four firms have considerably elevated their share of the market, through organic growth and a large number of purchases. The very best 10 consultancies take into account 52% from the market, while down the road the very best 200 service companies with talking to services hold 79% share of the market, recommending a non-fragmented and bringing together market based on the experts.

The very best 10 consultancies take into account 52% from the market, while down the road the very best 200 service companies with talking to services hold 79% share of the market, recommending a non-fragmented and bringing together market based on the experts.

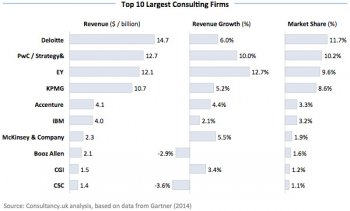

Deloitte Talking to ranks for that 4th year consecutively because the biggest talking to firm from the globe. Deloitte's top position is caused by two key reasons: it's the only among the Large Four that didn't divest its talking to practice between 2000 and 2002, additionally Deloitte can develop the largest palette of advisory services in comparison using its peers, particularly as it pertains lower to implementation services***. has acquired major terrain with the purchase of this past year for any reported $1 billion fee, the process &lifier procedures working as a consultant now renamed as EY's robust talking to growth was a mix of organic and inorganic growth. It's also prepared its assets, repositioned its strategy approach and eradicated challenges that membership firms typically face when ramping up global and regional assets.

keeps its 4th position. In 2014, KPMG's talking to service revenue was $10.7 billion, up 5.2% in comparison to 2013 ($10.2 billion). Its talking to talents lie mainly in the business talking to services, although KPMG Capital has assisted focus the firm in pointing its opportunities into focused solutions, for example security, risk, and knowledge and statistics.

rises one position to fifth. Accenture's talking to profile has based on Gartner a well-balanced mixture of a company and technology talking to service portfolio, using its key strength within the “cohesive approach” it keeps when supplying its clients. The experts also highlight Accenture’s effective strategy in creating a high-finish advisory practice, referred to as Accenture Strategy, to enhance its Digital, Technology and Outsourcing models.

RELATED VIDEO